In recent years, QR codes have become indispensable in various industries, with banking services being no exception. From secure transactions to enhancing customer engagement, QR codes in banking services have played a pivotal role in reshaping the way financial institutions interact with their customers. This article explores how QR codes are transforming the banking sector, the benefits of using QR code technology, and how tools like QR Code KIT’s dynamic QR code generator can revolutionize the customer experience.

What are QR codes, and how do they work in banking?

QR codes, short for Quick Response codes, are two-dimensional barcodes that store data. They are easily scanned with a smartphone camera, allowing users to access stored information, such as websites or payment details, almost instantly. In the banking sector, QR code payments have made transactions faster, more secure, and more efficient.

With the rise of mobile banking and digital payments, QR codes have become a popular method for financial transactions. QR code payment systems allow customers to make payments, check account information, and even pay bills with just a few taps on their smartphone.

Why are QR codes gaining popularity in the banking sector?

As digital transformation continues in the financial institutions sector, QR codes have gained traction as a quick and reliable tool to facilitate secure transactions. The ability to generate QR codes for a variety of banking services—such as payments, loan applications, and account management—has made them a valuable asset in mobile banking apps.

In particular, QR codes help streamline customer interactions by eliminating the need for traditional card swipes, PINs, or manual entries. Customers can now simply scan a QR code to complete transactions, whether they are purchasing products, withdrawing money, or accessing banking services.

How do QR codes benefit financial institutions?

For banks and financial organizations, the use of QR codes comes with numerous advantages. Here are some of the key benefits:

1. What are the security benefits of QR codes in banking?

Security is paramount in the banking industry, and QR codes offer a highly secure method for financial transactions. Unlike traditional methods, QR codes reduce the risk of fraud or human error by encoding payment information directly into the code. Additionally, many QR codes feature dynamic codes, which can be updated or revoked if necessary, adding another layer of security.

2. How do QR codes enhance customer experience in banking?

QR codes provide a fast and seamless experience for customers. With QR code payments, customers no longer need to carry physical cards or remember long account numbers. By scanning QR codes, they can access their account details, pay bills, transfer money, and even apply for loans in just a few simple steps. This improvement in customer experience also helps banks increase customer engagement and satisfaction.

3. Can QR codes improve transaction speed in banks?

Yes, QR code technology significantly improves the speed of payment transactions. Traditional banking methods, such as card swipes or cash deposits, can be time-consuming. However, by using QR code payment systems, transactions are completed in real-time, allowing for faster payments and reducing waiting times for customers.

How do different types of QR codes work in banking?

QR codes come in different types, each suited for specific purposes in the banking world. Some of the most popular types include:

1. What is a static QR code?

A static QR code contains fixed information, such as a URL or text. Once generated, the content cannot be altered. While static QR codes can be used for things like marketing materials or general bank information, they are not ideal for payment systems, where frequent updates to payment details are needed.

2. What is a dynamic QR code?

A dynamic QR code is more advanced, allowing for the data to be edited or updated even after the code has been printed. This flexibility makes dynamic QR codes perfect for banking services, where payment details, transaction amounts, and destination URLs might change. Financial institutions can easily adjust the data without having to generate a new code.

3. How do QR codes in mobile banking apps work?

In mobile banking, QR codes are commonly used for making payments, viewing account information, or transferring money. Through a mobile banking app, customers can simply open the app, scan a QR code, and instantly access their account details or complete a transaction.

4. How can banks use QR codes for loan applications?

For loan applications, QR codes can be employed to streamline the process. By scanning a QR code, users can quickly access the bank’s loan application form or customer service portal. This reduces the need for paperwork and accelerates the approval process.

Why should financial institutions adopt unified QR codes?

The rise of instant payment networks and global mobile technology markets has led to the development of unified QR codes—standardized codes that can be used across multiple payment systems and platforms. By adopting unified QR codes, financial institutions can ensure that their customers can make payments or access banking services seamlessly, regardless of the service provider.

How are QR codes integrated with digital wallets and other payment methods?

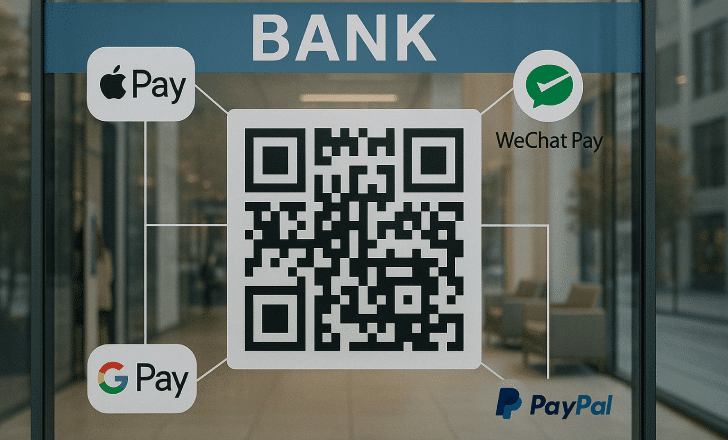

QR codes can also be integrated with digital wallets like Apple Pay, WeChat Pay, or OCBC Bank’s mobile app, allowing customers to make payment transactions directly from their smartphones. By linking QR codes with digital wallets, customers can access their bank accounts and complete transactions without needing to carry a physical card.

This integration of QR codes with digital wallets helps improve the payment experience, making it more convenient and secure for customers. With just a scan, customers can pay for purchases, transfer money, or access services like e-invoicing.

How do QR codes benefit consumers?

For customers, the use of QR codes in banking services offers a number of advantages:

1. What are the benefits of scanning QR codes for payments?

Scanning QR codes for payments is incredibly easy and convenient. Customers can complete transactions within seconds by simply pointing their smartphones at a QR code, making QR code payments the preferred option for many.

2. How do QR codes enhance security for consumers?

The ability to scan QR codes for secure transactions reduces the likelihood of fraud. As QR codes are unique and contain encrypted data, they minimize the risks of unauthorized access to payment information or bank accounts.

3. How do QR codes improve customer engagement in banking?

By allowing customers to interact with their bank accounts in a more engaging way, QR codes help improve customer engagement. Banks can use QR codes to provide personalized offers, track spending habits, and even offer loyalty rewards.

4. What role do QR codes play in facilitating faster payments?

As QR code payment systems continue to grow, customers are able to make faster payments and complete transactions in real time. This is especially beneficial in situations where time is of the essence, such as paying for groceries or withdrawing money from an ATM.

How can QR codes enhance financial services for businesses?

For businesses, integrating QR codes into their payment systems offers significant advantages. Businesses can use QR codes for bill payments, transactions, and even employee benefits like expense claims or payroll management.

1. How can QR codes be used for invoicing and payments?

By incorporating QR codes into invoices, businesses can enable customers to pay instantly. Instead of typing in payment details or account numbers, customers can simply scan the QR code to complete the transaction.

2. Can QR codes help banks with customer data collection?

Yes, QR codes provide a powerful way for banks to collect customer data. By linking QR codes to customized landing pages or forms, banks can collect vital information while enhancing the user experience.

What’s the future of QR codes in banking?

The future of QR codes in banking services looks promising. With the growing adoption of digital payments, QR code payments will continue to play a crucial role in facilitating secure, fast, and efficient transactions. As QR code technology advances, banks and financial organizations will have even more opportunities to improve their services and customer engagement.

Conclusion

In conclusion, c. By leveraging tools like QR Code KIT’s dynamic QR code generator, financial institutions can enhance customer experience, streamline payment transactions, and improve overall security. With their wide range of applications—from payment systems to loan applications—QR codes are poised to become an integral part of the digital banking landscape, offering both convenience and security to banks and customers alike.

Whether you’re a financial institution or a consumer, the potential of QR codes in banking is limitless. It’s time to scan the QR code and embrace the future of digital payments.